NEOBANKS

On top of your existing accounts, perform any banking operation. Allow customers, partners, and merchants to easily access financial services. Improve the consumer experience.

How Does It Work?

-

Step One

Authenticate Customer Identity & Onboard Via Kyc

Verify your consumers with KYC and onboard them smoothly. Perform extensive identification checks using government-issued IDs like Aadhar, PAN, and Voter ID, among others.

-

Step Two

Run Operations with Complete Compliance

Before hiring anybody or starting a business, identify the dangers. Conduct and automate income data checks, cross-verification of negative lists, and even behavioural data checks.

-

Step Three

Simplify Collections via UPI

Create UPI payment links in real time that are white-labeled with your brand's identity and make collections easier. Alternatively, you can distribute payment QR codes that are static or dynamic. Use UPI deep linking to allow your customers and partners to pay using popular UPI apps like Google Pay and PhonePe.

-

Step Four

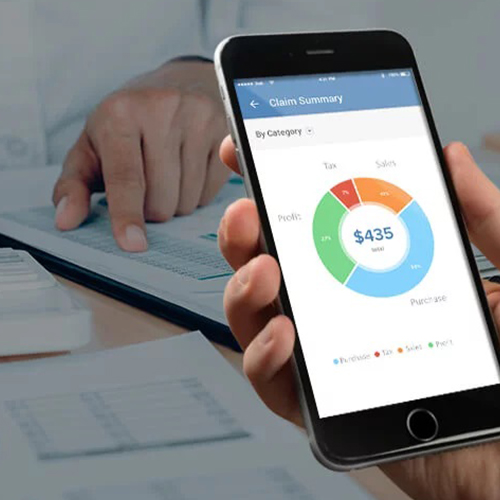

Track Spends & Streamline Expenses with Cards

Prepaid card programmes can be easily set up and managed. With co-branded cards, your consumers may spend wisely with their partners, merchants, or other customers. A dedicated dashboard keeps track of all expenditures.

-

Step Last

Facilitate Lending for Existing Customers

Use Decentro's lending stack to provide your customers financing choices. Manage many loan applications at the same time. From simple disbursements to flawless collections and holding accounts, run the whole cash flow cycle.